Payment trends 2023

Middle-market companies embrace modern payments, yet traditional methods persist

Treasury departments are embracing social tokens, real-time payments, virtual cards and other digital innovations for their speed, security, convenience and cost advantages, according to research from Citizens. Yet, the traditional payment modes – checks, automated clearing house (ACH), and physical credit cards – still have a stronghold. As payment types proliferate, middle-market companies could be missing an opportunity to streamline and be more strategic about their payment toolkit.

The survey of 205 treasury executives at middle-market businesses ($50M to $1B annual revenue) aimed to track company use of payment modes today and see what treasurers think of their options.

Key themes to watch

1

2

3

4

- Matt Richardson

Head of Treasury Product Solutions

With a menu of payment methods, businesses are using a custom mix

Middle-market companies report that they use about five payment methods on average. One in 10 companies uses all eight of the payment methods listed in the survey.

As the menu of payment methods expands, companies are assembling a custom mix to meet their needs – but they could be overlooking the strategic benefits to streamlining or upgrading outdated modes. Payment usage is all over the place, with all payment methods included in the survey showing some popularity. Physical credit cards and wire transfers topped the list. Some of the relatively newer methods, like virtual cards, still face lower adoption levels. Half of businesses continue to use paper checks.

See definitions for payment methods

Wire transfers: These are direct and instantaneous transfers between two parties, usually on the SWIFT or Fedwire networks. They can only be initiated by the sender, not by the receiver, and are usually done through direct instruction to a bank. They can be domestic or international.

International/cross-border payments: These are any payments going between two countries. They can be done as wire transfers or sometimes by ACH.

Real-time payments: True "Real Time Payments” in the U.S. are limited and growing, but a number of payment methods nowadays appear to settle instantly or at least have same-day settlement. Examples include wire transfers, Zelle payments, same-day ACH, certain transactions on Venmo, PayPal, and CashApp, and of course the transactions that go through the actual real-time settlement system in the U.S. known as Real Time Payments (RTP). The RTP network goes through The Clearing House, and it is currently used by a small number of banks including Citizens.

B2C payment alternatives: We include in this category the peer-to-peer platforms including Zelle, PayPal, Venmo and CashApp which allow for contactless payment between two parties. Many of these payments are done on the ACH network.

Automated Clearing House (ACH): A network of domestic banks and other financial institutions that provide automated electronic transactions including transfers, direct deposits, and peer-to-peer payments. ACH is the U.S. version. Other countries have their own networks, like Canada’s Electronic Funds Transfer (EFT). ACH transactions are batched one to three times daily.

Checks: Paper checks are written by the sender in longhand or they can be printed, and they must be physically delivered to the receiver. Paper checks are usually not accepted for international transactions.

Virtual cards:

Companies also show a high level of interest in expanding their payment mix. Six in 10 non-users of real-time payments said they were “very likely” to consider incorporating them into their payments strategy. This is likely due in part to speed associated with real-time payment solutions. Only about 40% of non-users said they would consider virtual or digital credit cards or B2C payment alternatives (platforms like Venmo, PayPal or Zelle).

Companies are using B2C options like peer-to-peer payment for a number of treasury functions

Consumer payments have seen a lot of innovation in recent years, with new options like Venmo, PayPal and Zelle enjoying high adoption. Middle-market businesses have started to embrace these tools as well. Among companies who said they currently use business-to-consumer (B2C) options or are likely to in the near future, most say they’ll use these tools to pay vendors. Paying salaries is another popular choice. Nearly half of companies say they would use B2C alternatives to issue refunds. These high usage numbers suggest that non-users are missing out on a trend that peers are embracing.

One innovation in B2C technologies is the use of social tokens, which allow payment to be sent to a phone number or email address rather than needing bank account information. Most companies rate social tokens as both easy and secure, and they would use them for both bill pay and payment requests. They also like the security of not retaining bank account info on their servers.

Matt Richardson

Head of Treasury Product Solutions

Virtual cards have gained in ‘payment share’

Virtual cards, a digital alternative to physical credit cards, are another emerging payment technology that is earning more interest from middle-market companies. The sectors with the highest virtual card adoption include human capital management and business services. These sectors typically have a less complex accounts payable environment with a supply base that tends to be more susceptible to accepting card payments. Consumer sector businesses have been the slowest to adopt virtual cards. It is possible that companies not using virtual cards are overlooking one of their benefits as a secure replacement for paper checks.

Rodrigo Sanchez

Head of Commercial Cards

The more gradual embrace of virtual cards could be connected to broader concerns that treasury executives have around visibility, control, security, and fraud related to their payments. Companies report many benefits to digitizing payments, but some also indicate in the survey that digitization has posed new challenges of security and integration.

Michael Cummins

Head of Treasury Solutions

Real-time payments and same-day funds have continued to climb in popularity

Treasury departments must be hearing the buzz about same-day and real-time payments (RTP) options, which are met with very high satisfaction levels among users. True "real-time payments” in the U.S. are limited and growing, but a number of payment methods nowadays appear to settle instantly or at least have same-day settlement. Examples include wire transfers, Zelle payments, same-day ACH, certain transactions on Venmo, PayPal, and CashApp, and of course the transactions that go through the actual real-time settlement system in the U.S. known as Real Time Payments (RTP). The RTP network goes through The Clearing House, and it is currently used by a small number of banks including Citizens. 100% of treasurers who use some kind of real-time or same-day payment say that the method has improved their company’s current payments process – and 87% say the improvement has been significant.

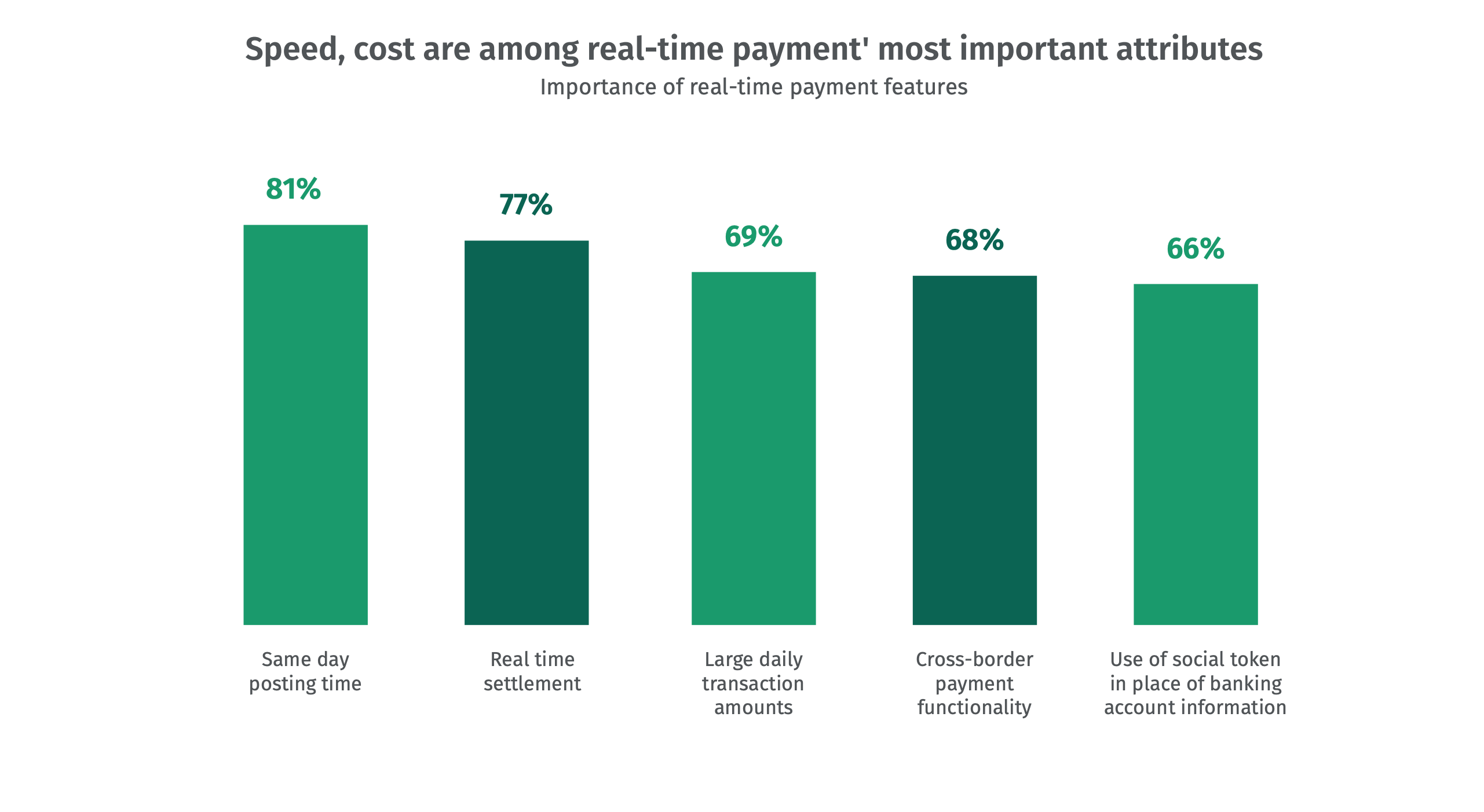

As the name suggests, “real-time payments” have a huge speed advantage over traditional checks. Middle-market companies say that speed is the most important attribute of real-time payments to their customers. 81% cited the same-day posting time and 77% named the real-time settlement as critical or important features for their customers. Still, other attributes of quick-settling payment methods are also highly valued, including large daily transaction limits, cross-border functionality, and the use of social tokens.

The 2023 payments survey revealed that middle-market companies continue to embrace modern payment options. Still, the traditional payment technologies remain important. When asked which payment modes are critical for their clients and vendors, middle-market firms were most likely to cite traditional payment types – ACH, credit cards and checks. Companies are embracing the new, but the old is not so easily phased out. It could be that companies are just adding more payment modes rather than replacing old modes with new ones.

More is not necessarily better, when it adds complexity to treasury processes. Middle-market companies should regard their payment mix from a strategic standpoint, looking for ways to streamline and optimize their treasury functions while taking advantage of the evolving benefits that emerging payments offer.

A look at the 205 survey respondents

We surveyed executives who are:

-

C-level executives and/or heads of Treasury or Accounting

-

Decisionmakers for their company’s treasury functions

-

At middle-market businesses with annual revenue between $50 million and $1 billion who operate in non-banking sectors

Fielding was conducted between February and March of 2023 in partnership with research firm Escalent.

Action items to consider:

- Conduct a review of your current payment mix. Look at the proportion of payments your company is making across different methods so you can compare it with your industry peers and middle-market companies more broadly.

- Open the discussion at a strategic level to look at payment preferences across your vendors and clients. This process could reveal opportunities to better meet their needs and strengthen relationships.

- Learn more about social tokens and how they are being used in your industry today.

- Assess your continued use of checks. For some middle-market firms, the options have broadened such that you may leapfrog from checks to one of the new digital payment modes like virtual credit cards or real-time payments.