Refinancing: find out what your friends already know

You value the opinions of your family and friends, who want to help you get debt free. Get up to speed and understand the buzz on refinancing.

Explore Refinancing: find out what your friends already know

Benefits of paying off student loans

Average savings

Glossary

Getting started

Explore Refinancing: find out what your friends already know

Benefits of Paying Off Student Loans

Average Savings

Glossary

The benefits of paying off your student loans

01

Paves the way to reach other financial goals

Your debt-to-income (DTI) ratio is a sign of your financial fitness. Lower is better. A low DTI sends a signal to lenders that you’re able to responsibly borrow from them on loans, like a mortgage. By paying off your student loan, you lower your DTI.

02

Allows you to build up your savings

Once you’ve paid off your loans, you’re free to turn those previous monthly payments into savings. You could save the same amount or a portion of it to build up an emergency fund or boost your nest egg.

03

Helps with cash flow

Without those monthly payments, you’ll have more money available for expenses. Or you may want to reward yourself for paying off your student debt. A vacation sounds good, right?

04

Helps you handle other debt

If you have other high interest debt, you may want to focus on paying it down with the money you’re no longer using for student loans.

05

Looks good on your credit history

The credit bureaus know your payment history. When you’re on time, you’re looking good. Once you’ve made that final payment, however, you may see a dip in your credit score. It has to do with how credit scores are calculated. Don’t worry, though. Any drop is usually temporary.

The upside of clearing your student debt

- Financial freedom—plan, save, splurge.

- Less stress—financial, emotional, and physical.

- More free time—say no to that second job.

- Power to give generously—help those who helped you.

Video goes here

Average Savings

You could put money in your pocket by refinancing your student loans.

$0

Average yearly customer savings†

Advice from the Experts

Advice 1

Source

Donec et tempus lacus. Cras quis venenatis velit. Nullam feugiat, mauris non accumsan aliquet, dui justo tempor arcu, a placerat urna turpis at tellus. Suspendisse potenti. Duis facilisis nibh et sem rhoncus varius. Vestibulum ornare porttitor lobortis. Cras posuere felis id mauris commodo, quis lobortis nibh rutrum. Cras velit nisi, scelerisque quis dignissim a, egestas vel libero.

Advice 2

Source

Suspendisse potenti. Duis facilisis nibh et sem rhoncus varius. Vestibulum ornare porttitor lobortis. Cras posuere felis id mauris commodo, quis lobortis nibh rutrum. Cras velit nisi, scelerisque quis dignissim a, egestas vel libero.

Advice 2

Source

Advice 3

Source

Cras quis venenatis velit. Nullam feugiat, mauris non accumsan aliquet, dui justo tempor arcu, a placerat urna turpis at tellus. Suspendisse potenti. Duis facilisis nibh et sem rhoncus varius. Vestibulum ornare porttitor lobortis. Cras posuere felis id mauris commodo, quis lobortis nibh rutrum.

Suspendisse non erat a ante luctus maximus viverra ut sapien. Fusce placerat ligula sed mi dapibus, vel pharetra dolor lacinia

Testimonial 1

Source

Suspendisse non erat a ante luctus maximus viverra ut sapien. Fusce placerat ligula sed mi dapibus, vel pharetra dolor lacinia

Testimonial 2

Source

Suspendisse non erat a ante luctus maximus viverra ut sapien. Fusce placerat ligula sed mi dapibus, vel pharetra dolor lacinia

Testimonial 3

Source

Refinancing terms to know

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

APR

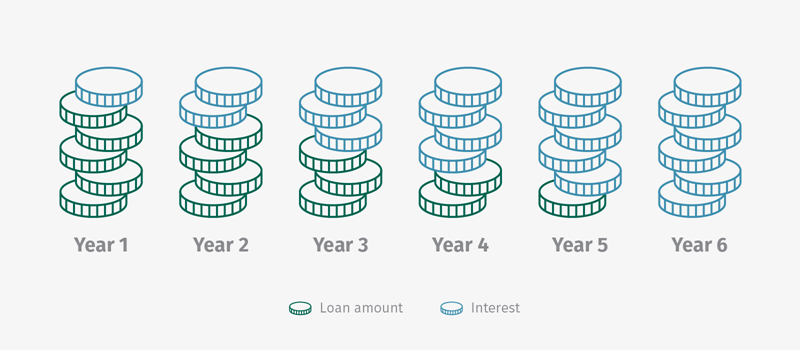

In simple terms, APR means annual percentage rate. It includes interest, fees and other charges from the lender. It’s the full cost of borrowing. Most lenders give the APR when discussing loans. This will be added annually and for the length of the loan.

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Consolidation

Think of consolidation like bundling: you’re combining multiple loans into a single one. You can consolidate your federal loans through a federal Direct Consolidation Loan or through a private lender by refinancing. You can also consolidate private student loans or a combination of private and federal loans through a private lender by refinancing.

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Deferment

For federal loans, a deferment is a temporary pause in your payments for specific situations, such as active-duty military service or economic hardship. Depending on the type of federal loan you have, you may not have to pay interest during deferment. Private lenders may or may not have deferment options.

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Federal Forbearance

Forbearance is a temporary pause in loan payments. A federal COVID relief plan paused the payments of borrowers with

federal student loans.Opens in a new window.APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Fixed rate

A fixed rate is just that, an interest rate that doesn’t change over the life of the loan. It generally will be higher than the initial rate offered on a variable rate loan.

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Refinancing

You refinance student loans through a private lender. The lender will pay off your existing loan(s) and you’ll have a new loan with new terms.

APR

Consolidation

Deferment

Federal Forbearance

Fixed rate

Refinancing

Variable rate

Variable rate

A variable rate can change over time. When it does, your monthly payment can change as well.

Additional resources

Student Loan Refinancing: What Are the Benefits?

Average Student Loan Debt Statistics

What’s Student Loan Deferment vs. Forbearance?

Fast track to financial freedom

It’s never too late to save. Get started and you could save on average $352† monthly when you refinance your student loans into one easy payment.